Table of Content

If you qualify for mortgage assistance payments for lower-income families under section 235 of the National Housing Act, part or all of the interest on your mortgage may be paid for you. You can use a special method to figure your deduction for mortgage interest and real estate taxes on your main home if you meet the following two conditions. You may be able to claim a mortgage interest credit if you were issued a mortgage credit certificate by a state or local government. Figure the credit on Form 8396, Mortgage Interest Credit. If you take this credit, you must reduce your mortgage interest deduction by the amount of the credit.

The IRS doesn’t initiate contact with taxpayers by email, text messages , telephone calls, or social media channels to request or verify personal or financial information. This includes requests for personal identification numbers , passwords, or similar information for credit cards, banks, or other financial accounts. Figure the average balance for the current year of each mortgage you took out on all qualified homes after October 13, 1987, and prior to December 16, 2017, to buy, build, or substantially improve the home . Add the results together and enter the total on line 2.

What’s not deductible

If you make payments to a financial institution, or to a person whose business is making loans, you should get Form 1098 or a similar statement from the lender. This form will show the amount of interest to enter on line 13. Also, include on this line any other interest payments made on debts secured by a qualified home for which you didn't receive a Form 1098.

Chester refinanced the debt in 1993 with a new 30-year mortgage. The refinanced debt is treated as grandfathered debt for its entire term . The date you take out your mortgage is the day the loan proceeds are disbursed. You can treat the day you apply in writing for your mortgage as the date you take it out.

Additional deduction under Section 80EE

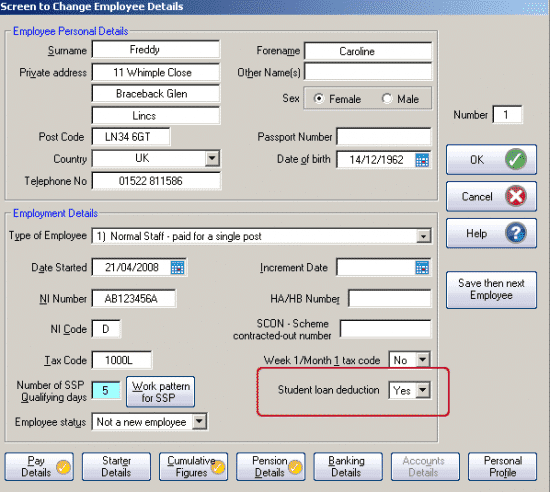

These can include payroll taxes and qualified health and retirement plans. Rules for what qualifies as a pre-tax deduction may change from year-to-year based on changes to federal tax law. You should also check with your state tax agency to find out what state or local tax deductions you may qualify for when filing your state income tax return. Tax incentives are government policies that attempt to get taxpayers to spend money, save money or encourage a particular behavior that benefits the country’s economy by reducing their tax bill. Tax deductions, tax credits and tax exemptions do this in different ways.

If you aren’t able to qualify for any tax deductions, tax credits might be another avenue to look into. A mortgage interest credit, for example, allows qualified homeowners to claim a credit on their tax return that’s worth a percentage of the mortgage interest they paid over the course of a given tax year. The mortgage interest deduction is a tax incentive for homeowners. This itemized deduction allows homeowners to count interest they pay on a loan related to building, purchasing or improving their primary home against their taxable income, lowering the amount of taxes they owe. This deduction can also be taken on loans for second homes, as long as it stays within the limits. The standard deduction in 2022 is $12,950 for single filers and $25,900 for couples who are married and filing jointly (rising to $13,850 and $27,700 in 2023).

Standard Deduction vs. Itemized Deductions

When you itemize deductions, including tax breaks for homeowners, you forgo the standard deduction. Instead, the total amount of the itemized deductions will offset your taxable income and lower your tax burden. Consult your financial advisor or tax professional to get more assistance with filing your 2021 tax return. They can provide even more information about your mortgage interest deduction and help you decide what to deduct based on the type of loan you have and your financial situation.

However, the amount of your grandfathered debt reduces the limit for home acquisition debt. On January 31, John began building a home on the lot that he owned. He used $45,000 of his personal funds to build the home. On November 21, John took out a $36,000 mortgage that was secured by the home. The mortgage can be treated as used to build the home because it was taken out within 90 days after the home was completed. The entire mortgage qualifies as home acquisition debt because it wasn't more than the expenses incurred within the period beginning 24 months before the home was completed.

Home office expenses

Go to IRS.gov/Coronavirus for links to information on the impact of the coronavirus, as well as tax relief available for individuals and families, small and large businesses, and tax-exempt organizations. If you used the proceeds of the mortgages on line 12 for more than one activity, then you can allocate the interest on line 16 among the activities in any manner you select . However, you can treat a debt as secured by the stock to the extent that the proceeds are used to buy the stock under the allocation of interest rules. Explain how to divide the excess interest among the activities for which the mortgage proceeds were used. A mortgage may end early due to a prepayment, refinancing, foreclosure, or similar event.

If you are looking to buy a house in Mumbai, you must check out the luxury projects of Piramal Realty spread across various regions of the city. Thoughtfully designed and executed, our housing projects offer state-of-the-art amenities in excellent locations. With our collaborations with some of the most celebrated architects and design firms, our projects have no dearth of excellence in design, amenities and construction. The users should exercise due caution and/or seek independent advice before they make any decision or take any action on the basis of such information or other contents.

Before you deduct home equity loan interest, you must ensure your loans qualify. Grandfathered debt, Fully deductible interest., Grandfathered DebtGround rents, Redeemable ground rents. FeesAppraisal, Amounts charged for services.Notaries, Amounts charged for services.Points Figures Form 1040, Schedule A, How To Report, Table 2. Where To Deduct Your Interest Expense Form 1040, Schedule C or C-EZ, Table 2. Where To Deduct Your Interest Expense Form 1040, Schedule E, Table 2. Where To Deduct Your Interest Expense Form 1040, Schedule F, Table 2.

Instead of reducing the amount of your income that’s taxed, a tax credit reduces how much you owe. The EITC benefits low wage workers, by reducing their tax bill or even returning them money. The goal is that this will encourage single parents to participate in the workforce.

A ground rent is an obligation you assume to pay a fixed amount per year on the property. Under this arrangement, you're leasing the land on which your home is located. If you sell your home, you can deduct your home mortgage interest paid up to, but not including, the date of the sale. This isn’t a secured debt unless it is recorded or otherwise perfected under state law. You can use Figure A to check whether your home mortgage interest is fully deductible. For more detailed definitions of grandfathered debt and home acquisition debt.

The funds were used to buy, build or improve a qualifying home. To qualify for the mortgage interest rate deduction, you must use the funds to buy a property, build your own home, or renovate your existing home. A few examples of substantial home improvements include replacing the roof, adding a room addition, or remodeling the kitchen.

No comments:

Post a Comment